Digits to Dollars China Highlights

This is a digest of highlights from news we found interesting about developments in China's semiconductor industry and electronics complex.

We are experimenting with Substack for this issue. Please drop us a line if you have any opinions on the new format.

We have just returned from Mobile World Congress so we are still catching up on news from last week. Here we take a look at some of the news and how geopolitics was playing out on the show floor.

Interesting Recent News

Don’t hate the Player, Hate the Game. IP has long been a sore spot in the wireless industry and between the US and China. So it is not surprising that the big Chinese electronics companies have become very aggressive patent filers. Huawei has been doing this for years, but many others are joining the fray.

A price war has broken out among the large Chinese battery makers, led by CATL. This is partly the result of weakened consumer demand, but it may also be a harbinger of consolidation which seems to be a hallmark of PRC industrial policy.

Cambricon was once among the hottest Chinese AI chip companies, but it fell on hard times even before ending up on the US Entity List.

Short-form video platform Kuaishou has decided to NOT build its own chip. Two things here. First, designing a chip is expensive and so even though arch-competitor Bytedance/TikTok is building its own chip, Kuaishou made the reasonable decision to not pursue this path. Second, there is this odd pattern in the PRC where Founding CEOs “retire”, but most people assume they still run things from behind the scenes. Here, the former CEO appears unable to pull the strings anymore.

An interesting read on what Huawei has become. They are doing a lot of different things, but also seem to be hanging on to the network equipment market.

Stewart Randall actually works inside China’s electronics complex. He takes a look at the industry post US sanctions, and finds a lot of activity, but also a lot of problems.

Most of the world uses Chinese branded smartphones. Here is a review of how that happened in Indonesia, where the China brands have 70% share.

Don’t hate the Player, Hate the Game. IP has long been a sore spot in the wireless industry and between the US and China. So it is not surprising that the big Chinese electronics companies have become very aggressive patent filers. Huawei has been doing this for years, but many others are joining the fray.

A price war has broken out among the large Chinese battery makers, let by CATL. This is partly the result of weakened consumer demand, but it may also be a harbinger of consolidation which seems to be a hallmark of PRC industrial policy.

Cambricon was once among the most advanced Chinese AI chip companies, but it has fallen on hard times even before ending up on the US Entity List.

Short-form video platform Kuaishou has decided to NOT build its own chip. Two things here. First, designing a chip is expensive and so even though arch-competitor Bytedance/TikTok is building its own chip, Kuaishou made the reasonable decision to not pursue this path. Second, there is this odd pattern in the PRC where Founding CEOs “retire”, bit most people assume they still run things from behind the scenes. Here, the former CEO appears unable to pull the strings anymore.

An interesting read on what Huawei has become. They are doing a lot of different things, but also seem to be hanging on to the network equipment market.

Stewart Randall actually works inside China’s electronics complex. He takes a look at the industry post US sanctions, and finds a lot of activity, but also a lot of problems.

Most of the world uses Chinese branded smartphones. Here is a review of how that happened in Indonesia, where the China brands have 70% share.

China at MWC

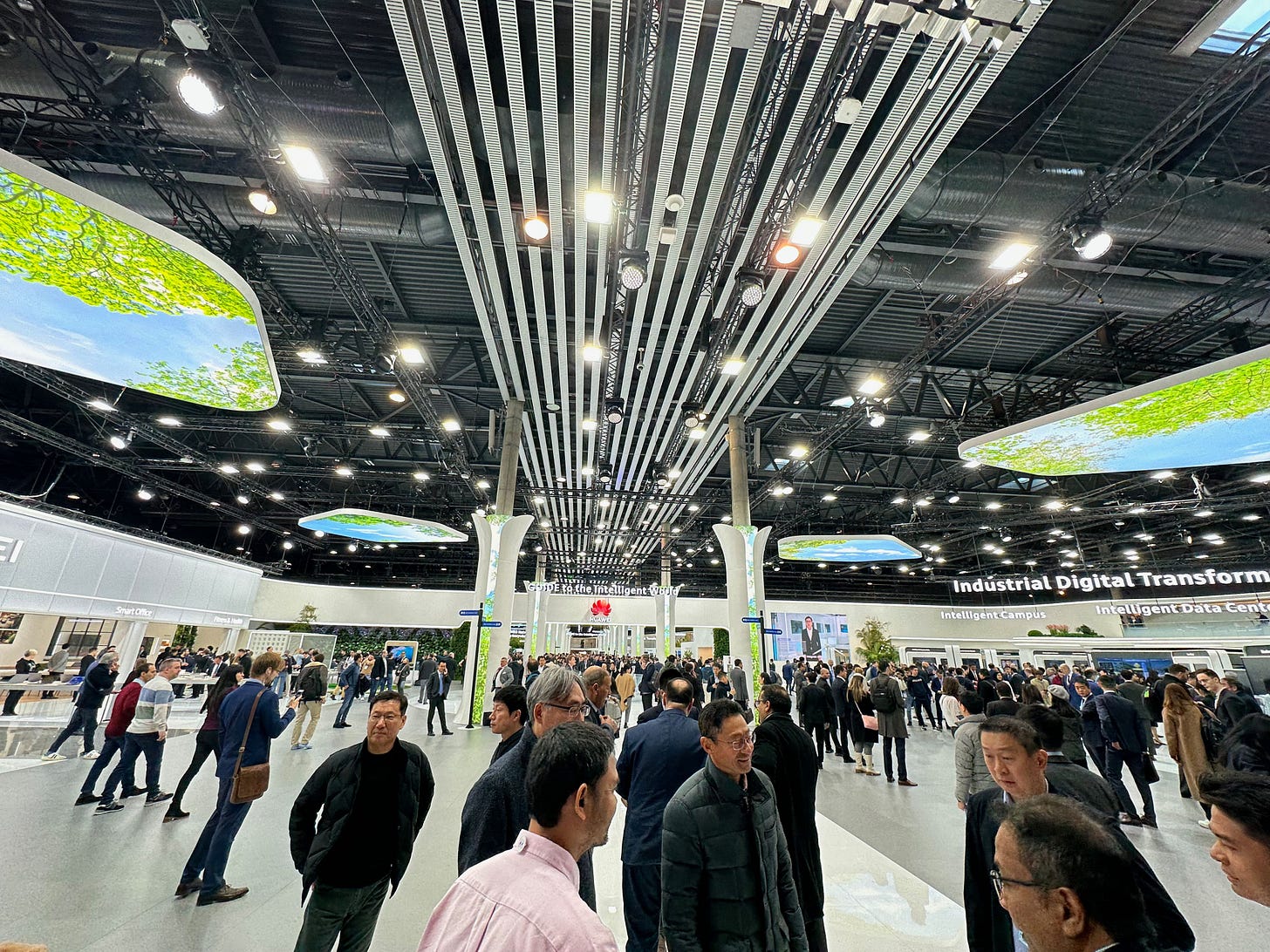

Among the most common questions we got asked about our recent trip to Mobile World Congress was “Did anyone from China show up?”. This is a big issue for trade shows. In early 2020, before anyone really understood Covid, the MWC planners waited to the last minute to cancel the show. The straw that broke the camel’s back in their decision making was the realization that no Chinese companies were going to attend, which led to a cascade of other companies canceling. In 2022, MWC went ahead, but those attending all noted that no one from China was there, marking a big absence in an otherwise surprisingly well attended event (for the times).

This year was different. Many companies from China did attend, but things are not quite back to normal for this contingent. Reservations for floor space had to be made almost a year ago, and at that time Zero-Covid was still in effect. This meant any attendees would have to undergo a few weeks of quarantine on return. We think this meant far fewer Chinese companies attended, at least a third less than in 2019, maybe more. That being said, those that show up, showed up with fully-staffed booths.

The major handset brands were there including Oppo and Xiaomi. The equipment companies showed up as well with large booths for both ZTE and Huawei. We also saw many of the equipment sub-system vendors, building radio units and cabling for the equipment majors and operators. This included companies like relatively new entrant Baicells and Hong Kong stalwart Comba, all duking it out in this very competitive corner of the market.

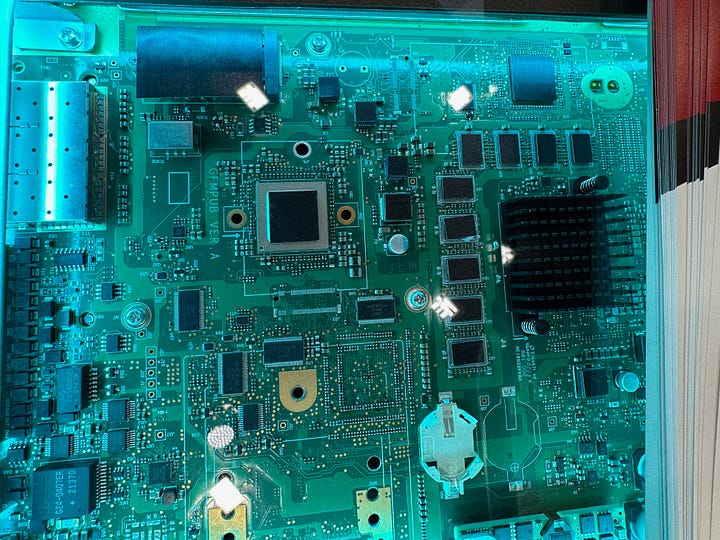

But this does not mean things are back to normal. In the Huawei booth we could not help but notice that of the dozen or so products viewable on the floor, every single chip on the board was taped over. Normally, only the key strategic chips on a board get this treatment, it is odd to mask even the micro-controllers and power ICs.

We pointed this out on Twitter, and inadvertently sparked a lot of strong emotions on both sides. Everyone seemed to think this was Huawei defending itself, but equally, Huawei was doing all of its chip vendors a big favor.

Similar to CES, we noticed that for any particular sub-segment where we once would have seen a half dozen Chinese competitors in this show there was usually only one. Again, we think this will be very different next year.

All in all, our sense is that everyone is adjusting to the new normal. The Chinese companies we spoke with were all very open and happy to tell us about their products. There was no secrecy or wariness around Americans. But at the same time, there were many little signs of changes in the geopolitical underpinnings of the industry. These ranged from the Western equipment makers oblique comments about gaining share due to “geopolitics”, to a Huawei booth that displayed products for every industrial vertical out there and thus much less focus on telecom. China is still a major market for vendors of all sorts, but in private conversations everyone we spoke with wondered how long that would last.

Just to let you know the first section is repeated, and in Outlook the content is stretched way beyond the right margin.