D2D Cont'd: Is M&A Coming for Semis?

This week we review data center market share and then look at how the M&A landscape for semis is shaping up.

Chart of the Week

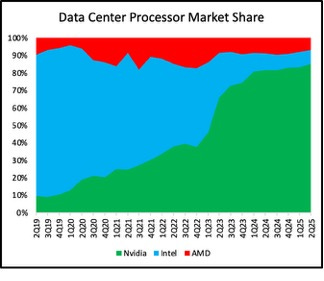

With earnings season upon us soon, we wanted to update our charts showing data center processor market share. The data from the last quarter marked a continuation of past trends.

Source: Company data and Seaport

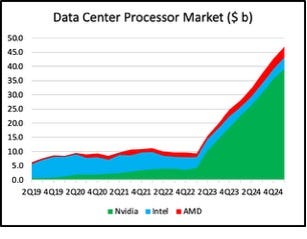

The standout feature of this image, of course, is that rapid growth of Nvidia and Intel’s collapse on the left. Lately we have been watching the right half more closely. Everything has stabilized. Nvidia’s share has been flat all year. This is really the heart of our bearish call on the company. It’s not that their results are terrible, but they have picked up so much share that it is hard to see how much upside they have left. In fairness, the market is still growing. The chart below shows the market in absolute terms.

Source: Company data and Seaport

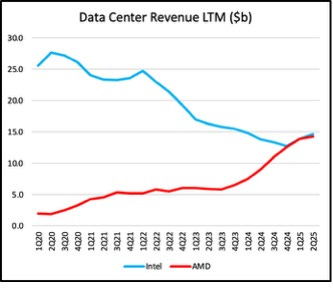

The other chart that we have also been watching lately is the fight for the left-overs between AMD and Intel. Two quarters back, AMD overtook Intel in the data center market, but has since fallen below. The chart below shows their revenue on a rolling, latest-twelve-month basis. Intel has collapsed, but maybe this chart show that their share has bottomed.

Source: Company data and Seaport

Growing M&A Potential and Risks

Interest rates coming down? Semiconductor stocks at all time-highs? Seems like that all means it’s time for M&A to hit the sector. We think there is a good likelihood of acquisitions picking up into next year. That offers opportunity, but given we have an equal number of Sell ratings as Buy ratings, that means there is a fair amount of risk as well. We obviously have no inside information about pending deals, but we do think the set up for deal activity looks very similar to past periods where deals picked up. Here we want to review the strategic rationale for deals in specific sectors.

Probably the largest question mark right now hangs over Intel. There have been press reports for years that various acquirors have taken a serious look at the company. At this stage, we think no one is likely to buy Intel without some form of resolution to the company’s fabs and Intel Foundry. We estimate Intel remaining a competitive chip manufacturer would require an investment on the order of $60 billion plus maybe another $20 billion in working capital. Intel does not have the resources to self-fund that (we estimate the gap there would be at least $20 billion plus the working capital). That leaves very few options for the company. At this point, it does not seem like there is any more money directly available from the government. In the near term, we expect potential Intel customers to invest in the company, following in the wake of Softbank and Nvidia. Apple, Google, Microsoft and Broadcom would all make sensible sources of funding. We believe Intel’s Board preferred outcome would be some form of investment and/or sale of the company’s fabs to TSMC. This deal would require “encouragement” from the US government, which seems a possibility.

So while an outright sale of the entire company is unlikely, there is a good likelihood of some form of corporate action.

Another important area to watch is networking. This is emerging as a key battleground in AI compute. Nvidia has built a formidable barrier to entry through tight integration with its NVLink networking stack. This gives its product a performance advantage and the company a considerable financial boost. Nvidia continues to build on this with the recent acquisition of Enfabrica. A key strategic initiative Nvidia has undertaken is to tightly couple entire designs of Nvidia-based systems – integrating networking, compute, memory and selling complete racks rather than discrete parts. This is forcing its competitors to respond. AMD has acquired ZT Systems to drive complete system designs and Pensado to give it a toehold in network interfacing. That being said, AMD lacks much in the way of advanced networking capabilities.

There are several options available to AMD on this front, none of them easy. Marvell may have much to offer. It has both networking products and a wide range of IP that could help bolster AMD’s AI ambitions. Offsetting these factors, Marvell’s networking capabilities are not complete, and it would take several years before the combination of the two had a truly competitive offering. Another possibility is Astera Labs. The company has clear traction in AI systems in the form of its business with Amazon. On the other hand, it’s networking offering is very narrow and would require even longer (and considerable investment) before they could build anything comparable to Nvidia’s offering. On top of that Astera’s stock has traded up significantly in recent years and this deal would likely be significantly dilutive to AMD. By contrast, Marvell’s stock has fallen out of favor due to the vagaries of its custom silicon business.

On that note, Marvell might be of interest to other companies looking to compete in the market for custom chips. Broadcom leads this business, and could not buy Marvell for anti-trust concerns as well as not fitting its target profile. In the past, AMD has spoken about entering the custom silicon business and may see appeal in Marvell for those reasons. Qualcomm has also said they would contemplate custom silicon projects “opportunistically” . We think their recent purchase of Alphawave was largely motivated by custom AI chips they are designing. Another potential acquiror that could make use of Marvell’s custom silicon capabilities is Arm. We believe, they are working on custom silicon as part of their initiatives to move up the value stack from licensing IP to actually designing chips. Such a deal would give us qualms, as Arm can likely achieve its goals organically or through smaller acquisitions, but buying Marvell may speed their time to market considerably.

The last area of potential activity is around core AI compute. By our count, there are over 60 start-ups designing AI accelerators chips. We think most of them will struggle to survive. As noted above, the market has moved past selling discrete chips, so these companies will need to design entire server racks. This is possible, but expensive. None of them have much in the way of networking capability. A few may be able to license Nvidia’s NVLink, but that will likely come with contractual shackles that limit their potential. Then they have to find customers. There are only about ten of these, most of whom are also designing their own chips. So in addition to competing with their customers, these start-ups would also have to compete with Nvidia and AMD.

The deck is stacked against them, many will fall by the wayside, but a few will get acquired. Those deals will likely come in some form of acqui-hires, where one of the hyperscalers wants to boost their internal design capabilities. AMD, Broadcom and Nvidia, may make a bolt-on acquisition for the same reason, but those companies do not need much support on this front. Similarly, Qualcomm may look to buy someone, if they are serious about their data center efforts. Perhaps the biggest outlier here is Intel. The company has essentially no AI strategy today. We could make an argument that after their deal with Nvidia they do not need their own AI products. That would be the extreme path. Instead, we think it is possible that they buy some of the larger AI start-ups out there, in a bid to jumpstart their strategy and maybe pick up some scattered design wins. To be clear, they have already done this. Twice. Neither effort made it very far. There is a reasonable chance that their new CEO could come up with a more serious plan to integrate any acquisitions into their offerings. On the other hand, the fact that he, or his venture firms, own stakes in many of those 60 start-ups may become a factor.

If you like this content you should listen to our podcast.