D2D Cont'd: Game Theory Gone Wild

The Questions We Get Most Frequently about AI

We spend a lot of our day talking about the AI Trade. Often the conversation focuses on some specific angle, where we end up getting deep into the weeds. Here we want to take a step back and try to tie the many threads together. We do this in the form of Frequently Asked Questions.

Are We in a Bubble?

Yes. We think we are in a Bubble. This bubble does not look exactly like any of the last few bubbles, but there are clear signs of exuberance. With strong emotions overriding commercial logic.

Unlike the 1990’s .com Bubble, many of the leading stocks benefitting from the Bubble are not trading at hyperbolic multiples. That being said, there are plenty of other similarities. Chief among these is the prevalence for redefining market realities. The level of exaggerated rhetoric around AI is steadily getting louder. This is not all wrong, but in much of the public discourse around AI (e.g. earnings calls and keynotes) many speakers tend to either make assumptions that are not yet proven, or just wildly exaggerated.

Our main concern about this Bubble is the extent to which all of it is rooted in the planned spending of six companies – Amazon, Google, Meta, Microsoft, OpenAI and Oracle – which we call the Sentient Six. Every growth story out there ultimately traces back to one of those six. And none of them are particularly clear about their business model for recouping their investment.

If so, how long will it last?

We have no idea.

Our current view is that we are in early stages of the Bubble. The recent trend towards the Sentient Six taking on debt likely means that the Bubble can keep going for some time, and get even more exuberant.

If only six companies are spending on AI will no one else get hurt when the Bubble bursts?

Unfortunately no. The scope of the Sentient Six’s spending is widespread. A wide swathe of the US economy now sees AI data centers as a major growth element. When the spending contracts, it will ripple across the broader US economy.

Can anyone displace Nvidia?

Not any time soon. They are the preferred solution for most developers doing serious AI work. Nvidia’s software, tools and libraries are now commonplace across the industry, making them the default solution. There are signs that this moat is slowly eroding, but that displacement will take time.

If that is true, how can you have a Sell on Nvidia?

This is by far the most common question we get. Our take is that Nvidia’s upside is largely priced in. There is more downside risk for Nvidia than there is upside risk, in our view. We have positioned our view on Nvidia as an “Underperform”, and on a relative basis this has actually played out fairly well. Yes, in absolute terms Nvidia has done well, but since we initiated in April it has lagged most of the other companies in the AI trade. We have long held that they are a good company with good products, but as the leader they attract the most attention and the list of companies looking to chip away at their success is growing.

Selected AI Stock Price Performance April 30, 2025 to November 5, 2025

Will hyperscalers all move to their own silicon?

All of the hyperscalers will make an attempt at designing their own chips. A few, but not all will succeed. Google has demonstrated the benefits of this approach with TPUs giving them a meaningful power/performance advantage. But this is not easy. Google has been working on TPUs for almost ten years. The next closest is Amazon with their Trainium chips. They are on the third generation, which is about how long it takes to get these projects to become effective. Microsoft is working on version 2 of Maia; we should know more about that chip’s performance next year. Meta is in disarray. OpenAI is working on its own chip too. And this is just the list of the big companies, many others are working on something too. We think that over the next three years many of these projects will fall by the wayside as the costs mount and companies lose patience. But some will succeed and become fixtures in the industry.

Why are the hyperscalers spending so much?

We think the foundation of the capex boom has become a self-perpetuating arms race. The Sentient Six are all worried that one of the others will achieve some major technical breakthrough and leave everyone else in the dust. This is a case study in Game Theory Gone Wild – it is not entirely rational, nor is it totally off base.

In addition, we think the cloud service providers have a legitimate concern that they will lose share to the neoclouds. We wrote about this a few weeks back. So far, the data does not show this clearly – the neoclouds have picked up only a few points of share – but the trend is clear. AI compute is growing much faster than CPU compute and there are hundreds of neocloud competitors fighting, clamoring at the walls of the decade-long AWS/Azure/GCP triopoly, which justifies some of the spending.

What are the economics of neoclouds?

A quick glance at the neoclouds financials can cause some pretty strong feelings. They are all losing large amounts of money and burning cash. But that distorts the unit economics of their business. Coreweave has 75% gross margins, the losses come from depreciation and capex. The fear is that expense never goes down, but the neocloud model can work.

What is the life of a GPU server?

The physical life of a server is seven years. After that, the equipment degrades to the point that performance suffers. However, the more important question is what is the economic life of a server?

A few months back we did some very rough math on unit economics for a GPU. In the early days of the AI Boom, the payback period for a GPU cluster could be as little as six months. We think that has extended out as competition has grown, but is still under two years.

By our (again, rough) math, GPUs are profitable for around three years. GPU economics are a race against time. New GPUs can command a pricing premium, but after a year, new GPUs come out, and prices for the old chips go down. At some point, the price of renting out that old GPU falls below the cost of the electricity required to operate them.

So the key to neocloud economics hinges on the pricing curves for old chips. This trend was starting to play out last year as prices for Hopper GPUS (H100, H200, etc.) began to dip in anticipation of the deployment of Blackwells. Then DeepSeek happened, and suddenly customers found they needed to do a lot more post-training work on their models. Prices for older chips spike up. Now almost a year later, gravity has returned.

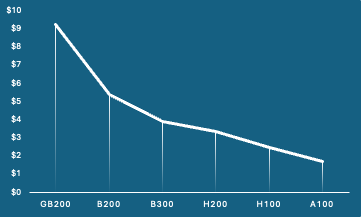

Spot prices for rental GPUs by Nvidia model

We gathered the data in the chart above from publicly available pricing on the websites of about 20 neoclouds. This is a raw average, and is illustrative not definitive. However, the trend is clear. Blackwell systems command multiples of older system. To be clear, even under these pricing conditions, neoclouds could still get reasonable paybacks for the GPUs, but older systems are borderline viable, at best.

How does circular financing work?

This is where we start to get into the heat of the Bubble fears.

The Sentient Six do not have enough electricity to build all the data centers they want. So they outsource that to the neoclouds, and now to a growing array of bitcoin miners, co-lo operators, real estate funds and anyone else with spare electricity. The hyperscalers would much rather own this themselves, but that is not an option right now. Those intermediaries do not have the capital to build out the data centers themselves, so they get debt financing, which is guaranteed by the Sentient Six and occasionally Nvidia. They then lease that capacity back to the Six. Nvidia-Coreweave-OpenAI-Oracle are the extreme example of this, but there are many smaller examples. This is not exactly circular financing, but is a high degree of financial engineering. We are concerned that ultimately we will get to a place where actual circular deals getting done – with companies trading revenue back and forth in a closed loop.

Can OpenAI pay for its commitments?

So far OpenAI has announced deals where it says it plans to deploy what we calculate as over $1 trillion of capex. It is hard to see them raising all that money, but their CEO probably knows more about pitching investors than anyone on the planet. We believe that OpenAI struggled with its last funding round, only to be saved at the last minute by Nvidia. So maybe they can keep it going, but a lot is riding on this very big uncertainty.

How is enterprise adoption of AI trending?

Our take is that enterprises are all testing AI with thousands of pilot projects, but most of these projects only generate modest returns. The biggest success to date by far has been with coding assistants, but there are numerous other examples. Every week, there seems to be a new study saying all enterprise AI pilots are failing or counter-productive. We do not think it is as bad as that, but we do think the scope of improvements generated by AI remains fairly small.

How is consumer adoption of AI trending?

For us, this is the biggest question of all. We do not believe that there is true, widespread consumer adoption of AI yet. Yes, OpenAI has something like $20 billion ARR, but that is small given the potential of AI (and OpenAI’s funding needs). For the most part, OpenAI seems to be doing best as an alternative to Google. This is not a new business model, just replacement of an existing solution.

If the Bubble is bursting where will it show up first?

We think the most vulnerable piece of the AI Trade right now is the rickety pyramid of data center deals. There are a lot of undercapitalized participants here deploying a lot of leverage. Small delays in timelines could lead to cascading disruptions and possibly failures. Could the bankruptcy of one small data center landlord drag down the whole AI complex? Probably not, but a series of interlinked defaults or covenant breaches could force some of the Sentient Six to be forced to backstop a debt chain, and that might be enough of a shock to the system that they reassess their spending. There are many other pitfalls and hazards out there.

Where could we be wrong?

We could be wrong in all of this. By far the biggest risk to our thesis is the invention of some incredible new AI model, or even just a great AI application. We believe this will eventually emerge, but on a time frame longer than the market is currently discounting. Technology adoption rarely happens in a straight line, especially for something as amorphous and large as AI could be. We think it will many years to find the best AI use cases and that will entail the semis industry going through a downturn in a cycle first.

Also, robots. Those are going to be a big deal someday, in our view.

Click here for full PDF report

If you like this content you should listen to our podcast.

This was excellent.