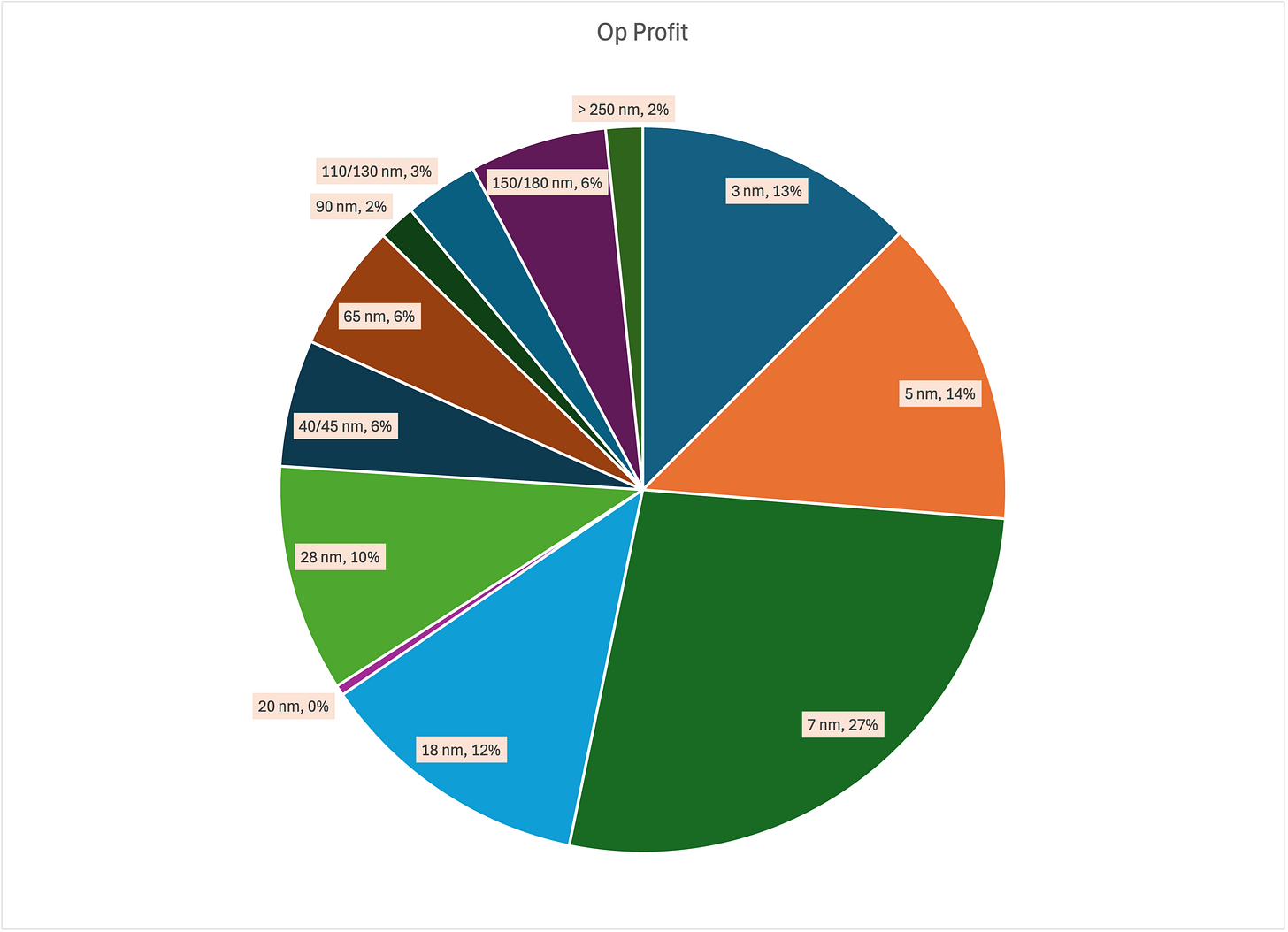

TSMC Operating Profit by Node. Source: D2D and company data

Just Two Lines

On the latest episode of the Circuit, we spoke with Simi and Chaim from Chips & Wafers (C&W) about their data sets. C&W is one of those great Alt-Data sources that is able to extract strong signal from a sea of noise. They have gathered an immense data store comprised of thousands of data points and more importantly the ability to pare all that down to simple, useful charts.

On the show we talked about the case of Besi, a WFE packaging equipment vendor. The C&W team showed how trade data painted one, somber, picture of the company’s China business at a time when the Street was focused on the company’s more glamorous AI-adjacent business. The China business contributed to the company’s revenues much more than the aspirational AI business. So when the data showed that Besi’s China business was slowing, C&W was able to correctly predict that the company’s results, and stock, would take a big hit.

C&W also shared with us a graph that shows their look into Apple. C&W tracked publicly available PRC data (the fact they could do even do this is fairly remarkable) showing a strong correlation between China smartphone exports and Apple revenue. It is easy to see how this could be used to build a stronger forecast of Apple’s results if tracked regularly.

Another intriguing example comes from ASML. Here the team shows the correlation between the PRC’s capital equipment imports from the Netherlands as a leading indicator of ASML’s stock price.

That last example also provides an important lesson in how to use the C&W data. As insightful as it can be, it should not be used in isolation. Anyone following ASML’s stock would need to know the context for the company’s China revenue. There are no silver bullets in data sourcing for investing, just a vast sea of mosaic tiles. Put enough of them together and the picture starts to emerge.

As analysts, we have long understood our role is to dig deep into available sources and judge where the real strategic insight rests. It is not enough to report facts, nor to provide a bottomless list of technical specs. Instead, our goal is to find that happy middle - highlight key trade-offs with just the right amount of technical knowledge.

What really intrigued us the most about C&W is the fact that almost all of their graphs show one, or at most two, data series. Just two lines, but that can be enough to mean the difference between ‘just’ data and actual information.

If you are interested in learning more about C&W, contact them at Chipsandwafersdata.com. Use code: TheCircuit to get a $500 discount. The data shown here and shared on the show are just small samples of their trove of insights.

Highlights from Our Blog

Most readers are, by now, familiar with the fact that TSMC generates a lot of its profits from trailing edge processes. We did some math, to see just how much profit that means. TSMC generates about half its revenue from 7nm and older processes, but over 70% of its profits from them. That being said, the leading edge nodes, 3nm and 5nm, are rapidly increasing their profitability, they actually lost money last money last year, but profitability seems to be increasing rapidly.

We attended Nvidia’s GTC and listened to multiple online streams from the event. Overall, we left the show basically where we entered. Nvidia continues to execute its on its hardware incredibly well - posing big challenges for alternatives from hyperscalers to start-ups. We were a bit disappointed with the software and applications side of the show. Nvidia seems to be positioning itself to move AI workloads away from the hyperscalers to “AI Factories”, which we think will be harder to pull off.

One constituency that is feeling the brunt of Intel’s struggle are the server and specialty equipment makers in Taiwan. Taiwan’s electronics complex was largely built on the back of Intel’s rise to prominence in servers and the cloud. It is not clear what is going to happen to all those vendors with Intel on its backfoot and Nvidia’s drive to build its own, newly reformatted, hardware ecosystem around AI.

Our favorite topic of the year is a the emergence of a new wireless standard - Sparklink. Our guess is that most readers have never heard of it, but this Bluetooth alternative has already shipped over 100 million units. That is still much smaller than Bluetooth which ships close to 2 billion units a year, but is large enough to imply a fair degree of commercial traction. We like wireless standards, so learning about Sparklink was like finding a buried treasure. But like any fairy tale, at the end of this electromagnetic rainbow, the treasure is guarded by a ‘bogeyman’, because of course, this standard was created by Huawei. The Sparklink alliance has hundreds of members, all based in China, covering every corner of the tech industry. Most intriguing, we understand that several major foreign brands are going to adopt the standard for their devices soon. So is it just a matter of time before Apple has to incorporate Sparklink in the iPhone to remain competitive in China?

If you like this content, you should check out our podcast The Circuit

Thank you for reading D2D Newsletter. This post is public so feel free to share it.