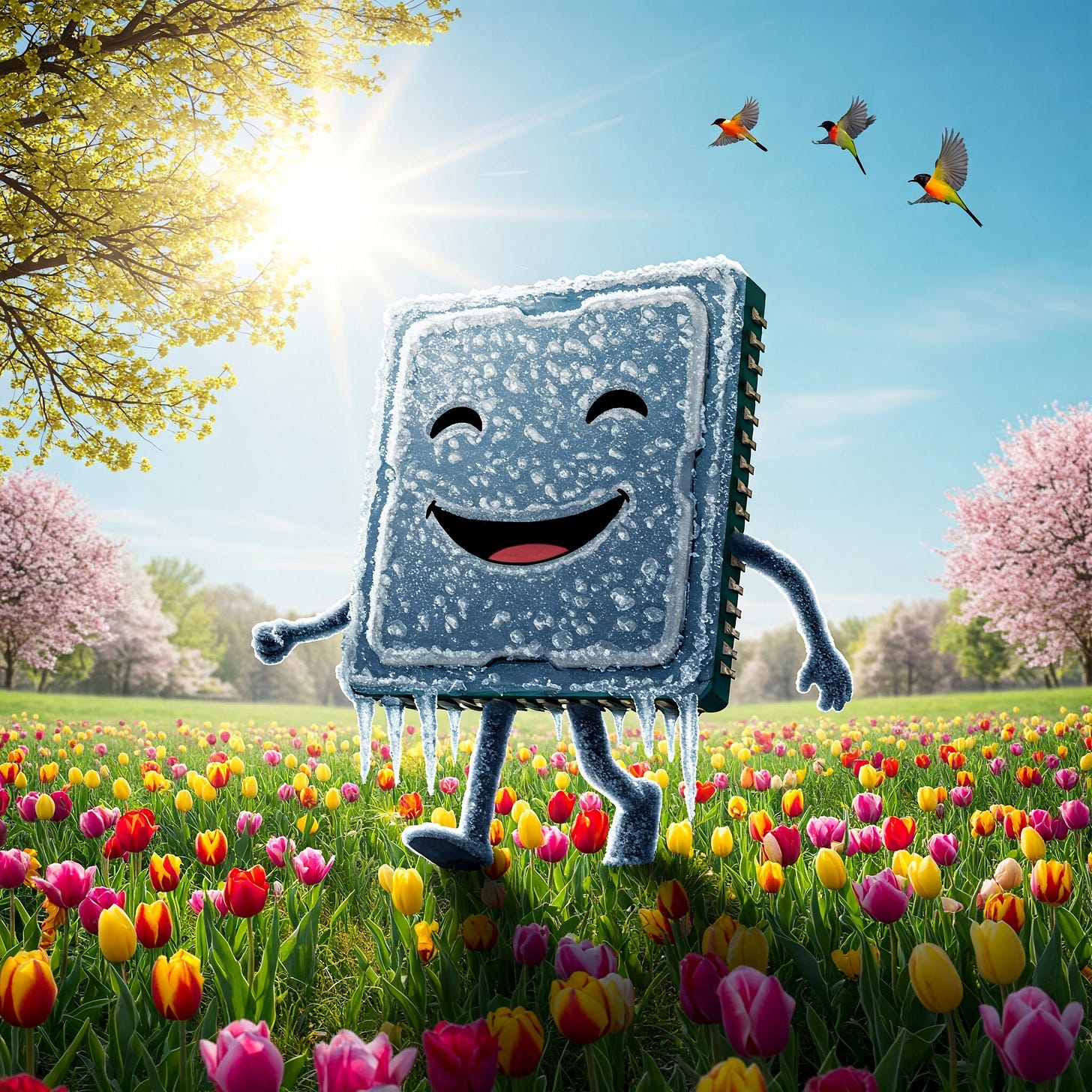

D2D China: Is is Springtime for PRC Semis?

DeepSeek brings renewed confidence, Huawei deepens its auto ecosystem, Samsung signs a patent license with YMTC, and more.

Is China’s semi industry turning a corner? The Deepseek launch has given a big boost of confidence to many in the PRC’s tech sector. At the same time, the harsh realities of too many competitors chasing the same segments remains. A few leaders may pull ahead, but for many companies Spring has not yet arrived.

This portion of the newsletter is free, but to read the whole night please subscribe to our paid version.

Noteworthy Items

Semis and Deep Tech

Battery and auto maker BYD announced that it has produced its first solid state battery. Solid state batteries are a long-sought after advance in battery technologies that promise 600+ mile EV range. It sounds like this is still far from commercialization, but BYD is good at that part of the process. Battery giant CATL also seems to be fairly far along with its solid state project as well.

One overlooked impact of Deepseek’s launch last month was the shot in the arm it gave to China’s tech industry. There is a sense of newfound confidence and even optimism after years of bad news. A second derivative impact of that has been a surge of interest in AI. This apparently extends beyond hyperscalers to broader enterprises, who are now apparently lining up to buy H20 systems from Nvidia (or some intermediary). Notable because our sense is that AI adoption among US enterprises remains a bit more tentative, and still largely bound to the hyperscalers. Maybe we should not read too much into this, but it is notable.

A Malaysian company is buying Silterra, a foundry that produces a range of chips and MEMS in its 8-inch foundry from the Malaysian government. Silterra was once Malaysia’s flagship property for moving up the stack from back-end packaging to higher-value foundries. The acquiring company Dagang NeXchnage received funding from a well-known Beijing-based investment group. We do not think we are going out on a limb to guess that the buyer has close ties to the PRC.

China Semis conditions are getting worse! GPU maker Muxi just laid off 200 people. China semis are seeing the dawn of a new Spring! DeepSeek has renewed hopes among China semis companies. Both of these can be true. A periodic reminder that China is a big place and things can be complicated there. Also, more much-needed M&A, this time in the MCU space. We also found this piece about Arm-based CPU designers in China. It is difficult to parse, and just confusing when translated, but basically argues that many of these companies are suffering from a glut of competition, US restrictions and ambivalence of corporate Arm about the space.

Samsung licensed NAND patents from YMTC. Maybe this is just one of those cost-of-doing-business-in-China events, but it raises a lot of questions about Samsung’s capabilities.

A comparison of US/EU and PRC microcontroller results. The Western companies were much more cautious and downbeat, while the China companies looked pretty good. The difference is China EVs, which seem to be holding up the entire global analog chip industry.

A review of results from China’s three largest foundries - SMIC, Hua Hong and Jing He. A good summary of their relative positions - SMIC at the “leading edge”, Hua Hong in specialty process, and Jing He display panels. All three are doing well.

Huawei

A fairly vitriolic overview of Huawei’s venture arm Hubble. Huawei has some fairly broad ambitions, which seem to include all of technology. We think the key thing to watch here is all the work they are doing across the semiconductor wafer fabrication equipment (WFE) space, from designing their own EUV light source to all sorts of advanced materials work. We think that everyone needs to start thinking of Huawei as a lot more than just a networking company, it is the spearhead of China’s deep tech industry.

Lots of Huawei automotive news lately. They signed a deal with Auto OEM Xpeng. The two companies have worked together for a long time, and our sense is that the latest deal extends into autonomous, or at least ADAS, software design. Also, pictures of a new GAC car, built with Huawei software have emerged as the car readies for its official launch.

Software

There has been a lot of news in the US lately about the massive capex budgets that the hyperscalers are deploying this year. The PRC has its own hyperscalers, and they are spending a lot as well, but they really do not want to talk about just how much they are spending. Bytedance wants everyone to know they are NOT spending $12 billion this year. Maybe it’s $11 billion or maybe it’s $24 billion, but its definitely not $12 billion.

Not wanting to be left out of the party, Alibaba says it will spend $50+ billion on AI capex this year. This keeps them in contention among the US hyperscalers who are all spending even more.

AI Company Deemos raised “tens of millions of dollars” in its Series A financing. Deemos apparently reached $1 million in ARR 45 days after launch with its Hyper 3D image generation service, running on its Rodin model. The pace of AI activity in China is just as frenetic as it is in the US, probably more so. Deepseek’s foundational model has grabbed all the headlines, but we think it is equally important to see what applications and use cases PRC companies are building with AI. There is a high likelihood that some of the biggest consumer AI applications will come out of China.

BYD has moved its public cloud repository from AWS and GCP to Ali. Significant for two reasons. The first is the geopolitical angle - a major company moving to a domestic supplier. The second is what it says about Ali. The company has been in the penalty box for a few years, and BYD would not have made this move without some tacit official blessing. It also serves as an important validation of Ali’s public cloud capabilities.

Automotive, Industrial and Macro-Economics

The CEO of CATL introduced a new acronym. Electric Vehicles (EV), he said, are transitioning into Electric Intelligent Vehicles (EIV). Normally, we do not put much stock in such pronouncements, but we think there may be something more substantive going on here. At the very least, we need to start thinking about the functionality of cars in terms beyond mere transportation. Of course, this all boils down to software, but CATL probably sees every China auto OEM’s roadmap and sees something important happening. And extra credit, CATL is also now building robots too.

We mentioned Xpeng’s “Aircraft Carrier” car last month, with pictures from CES. It turns out the car is set to go into production later this year.

We also bookmarked a dozen stories about PRC Auto OEMs’ overseas expansion plans, but it got to the point where there were too many to list. Put simply, China’s EV makers continue to expand massively around the world.

Diversions

Sometimes we read PRC policy documents, for fun. Here is a good interpretation of the latest government leading document setting out formal agricultural policy. For those whose idea of fun does not include such documents, we still suggest that it is worth a read. Much is made of the PRC’s seemingly “highly streamlined policy making process”, to the point that we know many compare it favorably to whatever is happening in DC right now. Dig a little deeper and it should be abundantly clear that high level pronouncements from Beijing are not the same as efficient policy on the ground, or in this case, in the ground.

If you like this content, you should listen to our podcast.

For paid users, we look at the health of China’s semis industry. Is it thawing after a long winter? Is Spring coming? And what role does DeepSeek play in this?

Keep reading with a 7-day free trial

Subscribe to D2D Newsletter to keep reading this post and get 7 days of free access to the full post archives.